Credit tips are like the secret sauce to your financial burger, adding flavor and ensuring it doesn’t end up a soggy mess. With the right strategies up your sleeve, you can elevate your credit game from okay to oh wow!

From mastering the art of timely payments to wielding credit cards like a seasoned magician, we’re diving into the nitty-gritty of credit management, debt relief options, and financial planning that’ll have your wallet singing and your credit score soaring.

Credit Management Strategies

Managing your credit can feel like juggling flaming torches while riding a unicycle, but with the right strategies, you can keep the flames at bay and your balance intact. Understanding and improving your credit score is crucial in today’s financial circus. Let’s break down some effective methods and techniques that will not only boost your credit score but also make you the ringmaster of your financial commitments.

Methods for Improving Credit Scores

Improving your credit score is akin to training for a marathon—it takes time, consistency, and a bit of strategy. Here are some effective methods to elevate that all-important three-digit number:

- Pay your bills on time: Late payments can feel like a bad breakup; they linger and affect your future. Consistency is key!

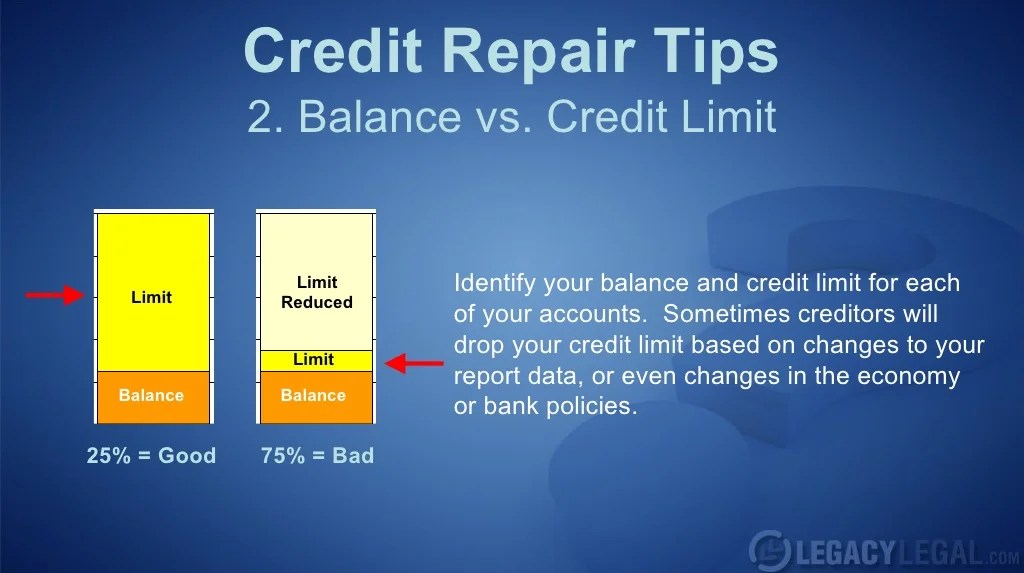

- Reduce your credit utilization ratio: Aim to use less than 30% of your available credit. Think of it as keeping your dessert intake to a reasonable slice instead of the whole cake.

- Keep old credit accounts open: Length of credit history matters. Don’t close that old card just because you’ve only used it once. It’s your trusty sidekick in the credit saga.

- Limit new credit inquiries: Each time you apply for credit, it’s like throwing a rock into a calm pond—it creates ripples that can impact your score.

Importance of Timely Payments

Timely payments are the bread and butter of a healthy credit history. They reflect your reliability and commitment in the eyes of lenders. Missing payments can lead to negative marks that might haunt you like an ex at a party. To emphasize the impact of timely payments, consider the following points:

“Paying your bills on time is the single most important factor in your credit score.”

- Each missed payment can stay on your credit report for up to seven years, which is longer than most of your friendships.

- Automate your payments to avoid late fees and the dread of forgetting due dates, making you the hero of your own financial story.

- Set reminders on your phone, or use budgeting apps to keep track of your payment schedules—because who doesn’t need a digital assistant nowadays?

Responsible Use of Credit Cards

Using credit cards responsibly is akin to wielding a powerful wand—you can create magic or cause chaos. Here are some important tips to ensure that your credit card usage remains a spell of prosperity rather than a curse of debt:

- Only charge what you can afford to pay off each month. Think of your credit card as a luxury sports car; you can drive it, but don’t let it drive you into debt.

- Make it a habit to review your statements regularly. Spotting discrepancies early can save you from unwanted surprises—like discovering you’ve been charged for subscription services you forgot about.

- Consider rewards programs, but don’t let them entice you into unnecessary spending. It’s like being lured by a shiny trophy; remember, it’s the journey that counts, not just the prizes.

Debt Relief Options

If you’ve found yourself in a pickle with debt that feels like a never-ending game of “Whack-a-Mole,” fret not! There are numerous debt relief options available to help you regain control, with strategies that can be as effective as they are diverse. From debt consolidation to negotiation tactics with creditors, let’s explore the avenues that can lighten your financial load and bring back your financial freedom faster than you can say “interest rate!”

Debt Consolidation Methods

Debt consolidation is like giving your financial obligations a swift makeover—taking several debts and rolling them into one tidy package, ideally at a lower interest rate. This method can simplify your repayment process while also potentially saving you money over time. Here are some popular methods:

- Personal Loans: These unsecured loans allow you to borrow a lump sum to pay off multiple debts. Touted for their fixed interest rates, they often lead to lower monthly payments.

- Balance Transfer Credit Cards: These cards let you transfer high-interest debt onto a new card with a lower rate, sometimes even a 0% introductory offer! Just remember, the clock is ticking on that sweet rate.

- Home Equity Loans or Lines of Credit: If you’re a homeowner, you can tap into your home equity for a larger loan with lower interest rates. Just be cautious—your house is on the line!

Each method brings its own set of pros and cons, but the goal remains the same: to make your payments more manageable and potentially save you some cash.

Negotiating with Creditors

Negotiation might not be as glamorous as a high-stakes poker game, but it can yield significant rewards for those willing to try. Engaging with your creditors could lead to better payment terms, lower interest rates, or even debt forgiveness, depending on your situation. Here are some key points to keep in mind:

“A little negotiation may just help you cut those monthly payments in half!”

It’s essential to approach your creditors with confidence and honesty about your financial situation. Here’s how you can enhance your negotiation tactics:

- Be Prepared: Gather your financial documents, and know exactly what you owe and your payment history. The more informed you are, the better your arguments will be.

- Propose a Reasonable Offer: If you’re suggesting a lower payment or a one-time lump-sum payment, make sure it’s something you can realistically follow through on.

- Follow Up: Don’t be afraid to reach out again if you don’t get the desired response. Persistence can pay off, especially when it comes to money!

Comparison of Debt Management Programs

When it comes to debt management programs, not all are created equal. Some are like a well-tailored suit—perfectly fitting your needs—while others might feel more like a potato sack. Here’s a look at some of the most common types and how they stack up against each other:

| Program Type | Benefits | Considerations |

|---|---|---|

| Credit Counseling | Personal guidance and budgeting help. | May require a fee, but often quite reasonable. |

| Debt Management Plans (DMP) | Consolidates payments and may lower interest rates. | Requires commitment and regular payments. |

| Debt Settlement | Potentially reduces total debt owed. | Can damage credit score and typically involves a lump-sum payment. |

Understanding these programs can empower you to make informed choices about your financial future. Each option presents unique benefits and considerations, so it’s all about what fits your situation best. By weighing your options wisely, you can navigate through the choppy waters of debt and set sail towards financial tranquility!

Financial Planning and Credit

When it comes to managing your finances, the intersection of credit and financial planning is crucial. The right strategies can help you unlock your financial potential, allowing you to make the most of what you have—like turning your home into a financial goldmine!

Home Equity Loans for Financial Stability

Home equity loans can be a powerful tool in your financial arsenal. They allow homeowners to tap into the cash value of their property, which can be used for a variety of purposes. This can help improve financial stability, especially in times of need. Here’s how you can leverage home equity loans wisely:A home equity loan can provide you with a lump sum that you can use for significant expenses, such as education, home improvements, or consolidating high-interest debts.

Essentially, it’s like turning your home into a piggy bank—just ensure you don’t break it open too haphazardly!

- Lower Interest Rates: Generally lower than personal loans and credit cards, making it cheaper to borrow.

- Tax Benefits: Interest on home equity loans might be tax-deductible, giving you more bang for your buck—consult with a tax advisor to confirm your eligibility.

- Fixed Rates: Many home equity loans come with fixed interest rates, allowing for predictable monthly payments—no surprises, just like a good sitcom.

- Flexibility: Use the funds for almost anything! From vacations to renovations, the world (and your home equity) is your oyster.

“Home equity loans are like that friend who lends you cash when you’re in a bind—but with more paperwork and a lower interest rate!”

Role of Credit Counseling in Personal Finance Management

Credit counseling plays an integral role in guiding individuals through the often murky waters of personal finance management. It can help people understand their credit reports, develop budgets, and navigate the complexities of debt. Credit counselors can provide tailored advice based on your financial situation, helping you make informed decisions that can lead to better financial health. Here’s why credit counseling is a game-changer:

- Personalized Guidance: Credit counselors assess your financial situation and create a tailored plan that suits your needs—kind of like having a GPS for your finances!

- Debt Management Plans: They can help you set up a debt management plan (DMP) that consolidates your debts into manageable monthly payments—like a financial support group, but with fewer snacks.

- Education: They provide resources and workshops to improve your financial literacy, empowering you to make smarter choices—knowledge is power!

- Stress Reduction: By having a professional guide you through your options, you can reduce the anxiety that comes with financial uncertainty—less panic, more planning!

“Credit counseling is like having a personal trainer for your finances—only instead of lifting weights, you’re lifting your credit score!”

Importance of an Estate Plan Trust in Preserving Financial Assets

Creating an estate plan trust is a critical step in preserving and managing your financial assets for the future. It ensures your wishes are honored and helps to minimize tax burdens on your loved ones after you’re gone—talk about a financial gift that keeps on giving!A trust can help manage your assets during your lifetime and ensure they are passed on according to your wishes.

Consider these key points about estate planning:

- Asset Protection: Trusts can protect your assets from creditors and lawsuits, shielding your wealth like a financial superhero cape.

- Tax Benefits: Well-structured trusts can help reduce estate taxes, maximizing what you leave behind for your heirs—because who wouldn’t want to leave a little something extra?

- Control Over Distribution: You can dictate when and how your assets will be distributed, allowing you to provide for loved ones at the right time—like a magician pulling a rabbit out of a hat, but legally.

- Privacy: Trusts are not public records, so your financial matters stay private, unlike your neighbor’s gossip about their vacation—no one needs to know.

“An estate plan trust is your financial legacy’s best friend—it makes sure your hard-earned assets are treated like the treasures they are!”

Concluding Remarks

In the grand finale of our credit circus, remember that managing your credit is more than just numbers; it’s about creating a solid foundation for your financial future. So, arm yourself with these tips, dance with your debts, and let your financial dreams pirouette into reality!

Question Bank

How often should I check my credit score?

It’s best to check your credit score at least once a year, but quarterly checks can help you spot any issues sooner!

What’s a good credit score range?

A score of 700 and above is generally considered good, while 750 and above is excellent!

Can I improve my credit score quickly?

Yes! Paying down high credit card balances and ensuring no late payments can give your score a quick boost.

What should I do if I find an error on my credit report?

Contact the credit reporting agency to dispute the error and provide any necessary documentation.

Is it bad to close old credit accounts?

Closing old accounts can hurt your credit score by reducing your credit history length, so keep them open if possible!