Grab your magnifying glass, folks, because we’re diving deep into the thrilling world of credit reports! These mystical documents hold the secrets to your financial fate, like a treasure map that leads to the hidden riches of loan approvals and lower interest rates. Who knew that a mere piece of paper could wield such power?

In this exciting adventure, we’ll demystify credit reports by exploring their components, understanding how scores are calculated, and revealing the impact of credit inquiries. Buckle up as we equip you with knowledge to navigate through credit counseling, management strategies, and handy tips for maintaining a sparkling credit history!

Understanding Credit Reports

Credit reports are like the report cards of the financial world, showcasing your creditworthiness to potential lenders. They contain vital information that tells creditors about your borrowing habits, payment history, and overall financial reliability. With great power comes great responsibility—knowing how to read your credit report can be the difference between getting that shiny new car or being stuck biking to work.

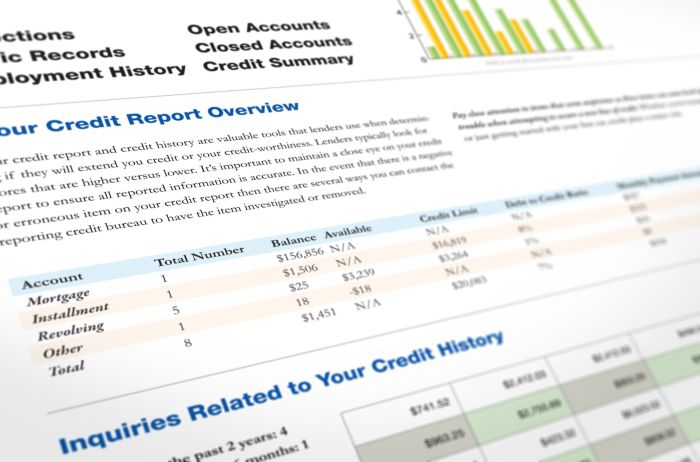

The structure of a credit report typically comprises several key components. These include personal information, credit accounts, payment history, and inquiries. Personal information consists of your name, address, Social Security number, and date of birth, which helps identify you. Credit accounts detail your loans, credit cards, and mortgages, while payment history tracks whether you’ve been a responsible borrower or have been known to throw a few late payments into the mix.

Lastly, inquiries reveal how many times lenders have requested your credit report, giving them a peek into your financial life.

Components and Structure of a Credit Report

To truly understand the nuances of a credit report, it’s essential to dissect its components. Each section plays a significant role in shaping your credit profile. Here’s a breakdown of the major elements:

- Personal Information: This section includes your name, current and previous addresses, Social Security number, and date of birth. While it might not include your favorite ice cream flavor, it’s crucial for identifying your credit history.

- Credit Accounts: This part lists your credit cards, loans, and mortgages, complete with account numbers, balances, and payment history. It paints a picture of your financial behavior—like how you treat your pet goldfish, but with money.

- Payment History: Here lies the tale of your payment habits. Did you pay on time, or did you throw caution to the wind? This can make or break your credit score—like the time you forgot your anniversary.

- Credit Inquiries: This contains a record of who’s been peeking at your credit report. There are hard inquiries (when you apply for credit) and soft inquiries (like checking your own credit). Too many hard inquiries can make lenders twitchy—think of it as them watching you try on too many pairs of shoes.

Credit Score Calculation

Credit scores are like the secret sauce of creditworthiness; they can range from 300 to 850, with higher scores indicating lower risk for lenders. The calculation of credit scores is based on several key factors, each contributing to that coveted three-digit number. The components that factor into your credit score include:

- Payment History (35%): This is the most significant factor. Consistently on-time payments can boost your score, while late payments can send it plummeting faster than a lead balloon.

- Credit Utilization Ratio (30%): This is the ratio of your current credit card balances to your credit limits. Think of it like the amount of cake you’ve eaten at a party compared to what’s left on the table; moderation is key!

- Length of Credit History (15%): Lenders prefer seasoned borrowers. The longer your credit accounts have been open, the better—as long as you haven’t made any major faux pas along the way.

- New Credit (10%): This includes the number of recently opened credit accounts and hard inquiries. Too many new accounts can make you look like you’re on a shopping spree, which might raise red flags.

- Types of Credit Used (10%): Having a mix of credit types, such as revolving accounts (credit cards) and installment loans (like mortgages), showcases your ability to manage different credit forms.

Significance of Credit Inquiries

Credit inquiries may seem like a mere footnote on your credit report, but they hold significant weight in the eyes of potential lenders. Understanding their impact on your credit score is essential for maintaining financial health.Every time a lender checks your credit report, a hard inquiry is recorded. Here’s what you should know about inquiries:

- Impact on Credit Score: Hard inquiries can cause your score to drop slightly, usually by a few points. It’s like a minor bruise—a bit uncomfortable but not the end of the world.

- Shopping for Loans: When you’re rate-shopping for mortgages or auto loans, multiple inquiries within a short time frame typically count as one inquiry. It’s like trying on different outfits—one outfit change might cause a stir, but multiple in a day can be forgiven.

- Time Frame: Hard inquiries remain on your credit report for two years, but their impact on your credit score usually fades after a year. Like that embarrassing hairstyle you had in high school that you eventually grow out of.

Remember, each credit inquiry is a peek into your financial world—make sure you’re not giving away too many front-row tickets!

Credit Counseling and Management

Credit counseling and management is like having a cool superhero sidekick for your finances, swooping in to save the day when debts feel like villains closing in. With the right strategies, you can wrestle your credit score into submission and emerge victorious. From understanding your financial situation to implementing a debt management plan, let’s dive into the world of credit counseling and some exciting ways to improve your financial health.

Strategies for Managing Debt and Improving Credit Scores

Managing debt effectively can feel like trying to balance on a unicycle while juggling flaming torches, but fear not! Below are some proven strategies that can help you regain your financial footing and boost your credit score.

- Create a Budget: Knowing where your money goes is crucial. Track your income and expenses, and allocate funds wisely. Consider using budgeting apps that make this task more entertaining than a cat video marathon.

- Prioritize Debt Payments: Focus on high-interest debts first, such as credit cards, while making minimum payments on the rest. This is known as the avalanche method. You can pretend you’re an avalanche expert as you crush those debts!

- Consider Debt Consolidation: Combining multiple debts into one can lower your interest rates and simplify payments. It’s like gathering all your pesky toys into one big, manageable box.

- Regularly Check Your Credit Report: Keeping an eye on your credit report can help you spot errors and potential fraud. Think of it as a detective solving the mystery of your credit history.

- Make Payments on Time: Late payments can hurt your credit score. Set up reminders or automate payments so you never miss a due date. Your future self will thank you!

Services Offered by Credit Counseling Agencies

Credit counseling agencies are akin to wise financial wizards, offering a range of services designed to help you tackle your debt dragons. Here’s a closer look at what these agencies provide.

- Debt Management Plans (DMP): Agencies create a budget and negotiate with creditors on your behalf, allowing you to make one easy monthly payment. It’s like having a personal trainer for your finances!

- Financial Education Workshops: Many agencies offer workshops to enhance your financial literacy. You’ll learn valuable skills that can turn you into a budgeting ninja!

- Credit Report Review: Agencies can help you analyze your credit report and provide guidance on how to improve your score. It’s like having a GPS for your credit journey.

- Individual Counseling Sessions: Personalized sessions help tailor advice to your unique situation. Think of it as a financial therapy session where you can spill your money woes.

Creating a Personalized Debt Management Plan

An effective debt management plan (DMP) is your roadmap to financial freedom. Here’s a step-by-step guide to crafting a DMP that suits your unique situation.

- Assess Your Financial Situation: Gather all financial information, including income, expenses, and debts. This is like making your financial yearbook!

- Set Your Financial Goals: Define what you want to achieve, whether it’s paying off debts or saving for a vacation. Dream big!

- Develop a Budget: Create a budget that allocates funds for debt repayment. Make sure it’s realistic and enjoyable (yes, fun budgets exist!).

- Choose a Credit Counseling Agency: Research and select a reputable agency to help you manage your plan. Think of them as your financial cheerleaders!

- Implement the Plan: Start making payments according to your DMP. Celebrate small wins to stay motivated!

- Review and Adjust: Regularly review your plan and adjust as needed to stay on track. Flexibility is key, like a yoga session for your finances!

“A budget is telling your money where to go instead of wondering where it went.” – John C. Maxwell

Tips for Maintaining Good Credit

Building and maintaining a solid credit history is not just a task for the financially inclined; it’s a duty we all need to embrace! Think of your credit score as a star rating for your financial behavior, and nobody wants a one-star review! Here are some tips to keep your credit shining bright, like a diamond… or at least a very shiny penny.

Actionable Tips for Building and Maintaining Strong Credit

Establishing good credit is like cultivating a fine wine; it requires patience, care, and attention to detail. Here are some actionable tips to ensure your credit score doesn’t end up with more drama than a reality TV show:

- Pay Bills on Time: Late payments are like a bad haircut—they linger longer than you’d like! Always aim to pay your bills on or before the due date.

- Keep Credit Utilization Low: Try to use less than 30% of your available credit. Think of it as not exceeding the buffet limit—just because there’s more available doesn’t mean you need to consume it all!

- Diverse Credit Mix: Having a mix of credit types (like installment loans and credit cards) can help boost your score. It’s like having a balanced diet; a little variety goes a long way!

- Avoid Opening Too Many Accounts at Once: Every time you apply for credit, it’s like ringing a doorbell; too much ringing and you may get ignored. Space out your applications for better results.

- Keep Old Accounts Open: The longer your credit history, the better. Closing an old account is like throwing away a vintage wine bottle—don’t do it unless you have a good reason!

Importance of Regular Credit Report Monitoring

Regularly checking your credit report is as essential as checking your fridge for expired food—nobody wants nasty surprises! Keeping an eye on your credit report helps catch errors and detect potential identity theft. You can obtain a free report from each of the three major credit bureaus once a year at AnnualCreditReport.com. Just remember, checking your own credit doesn’t affect your score—unlike your Aunt Linda’s opinion on your fashion choices!

Role of Home Equity Loans in Credit Health and Financial Planning

Home equity loans can be a double-edged sword—use them wisely, and they can be a fantastic financial tool! They allow homeowners to borrow against the equity built up in their property. Here are a few points to consider:

- Debt Consolidation: Home equity loans can be used to pay off high-interest debt, which could improve your credit score. It’s like trading in your old, clunky car for a shiny new ride with better mileage!

- Improving Your Home: Using a home equity loan for renovations can increase your home’s value and, consequently, your equity. Just be sure that the remodel doesn’t turn your castle into a haunted house!

- Lower Interest Rates: Typically, home equity loans come with lower interest rates compared to unsecured loans. It’s like getting a sweet discount on a luxury item—who doesn’t love that?

- Financial Flexibility: A home equity loan can provide funds for emergencies or major life events. Just make sure you’re not treating it like a personal ATM—responsibility is key!

Closing Summary

As we wrap up our escapade into the land of credit reports, remember that this document is more than just numbers—it’s a reflection of your financial journey! By mastering the art of credit management and keeping an eye on your report, you’ll pave the way for a bright financial future. Now go forth, brave financial adventurer, and make those credit scores shine!

FAQ Overview

What is a credit report?

A credit report is a document that Artikels your credit history, including your loans, credit cards, and payment behavior.

How often should I check my credit report?

You should check your credit report at least once a year to monitor your credit health and catch any inaccuracies.

Can I improve my credit score quickly?

While significant improvements take time, paying bills on time and reducing credit card balances can lead to rapid gains!

Do credit inquiries hurt my score?

Yes, too many hard inquiries can temporarily lower your credit score, so be sure to space them out!

How do I obtain my free credit report?

You can get a free credit report once a year from each of the three major credit bureaus at AnnualCreditReport.com.